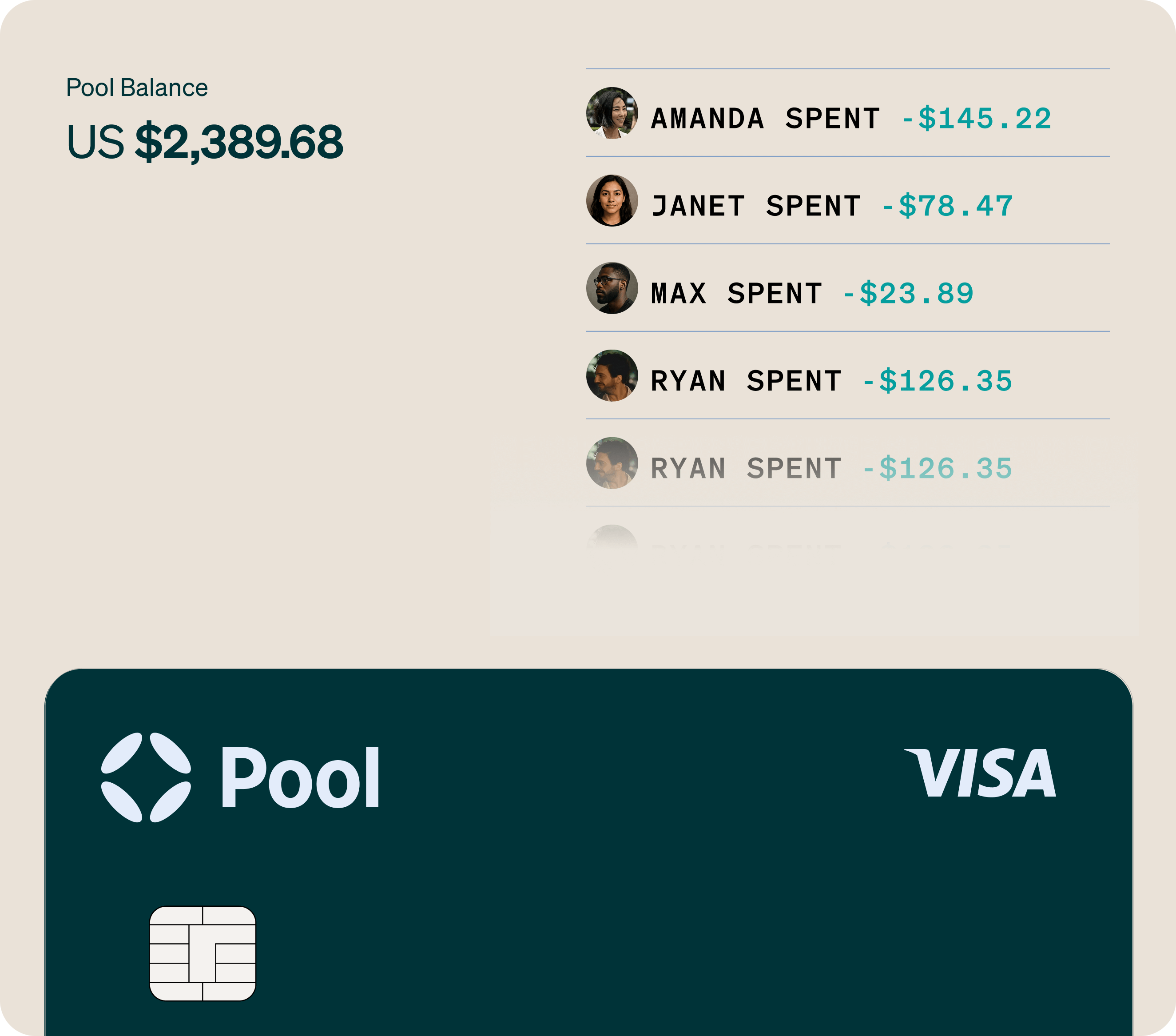

Shared money, made simple.

Introducing Pool, the shared financial

account* for every shared life.

Lake Monroe Cabin

We’re rebuilding the dock this spring

$5,478Pooled

Mission Marathons

Gear and travel for races

$2,745Pooled

505 Elm House Fund

Food, furniture, utilities and rent

$3,323Pooled